Avendus and Ernst & Young claim the No.2&3 slot

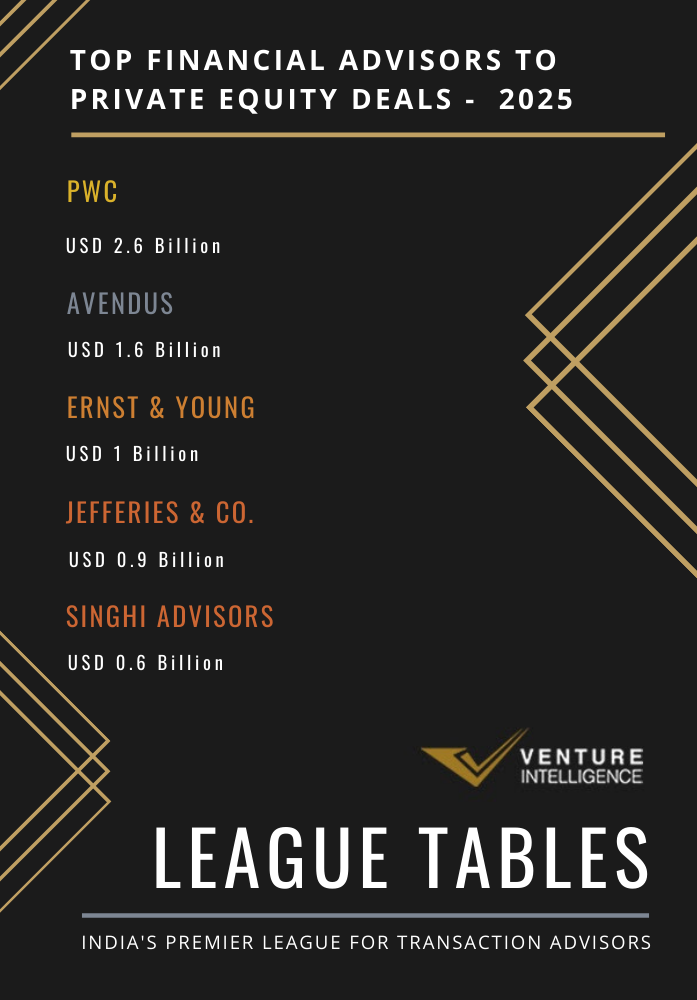

PwC topped the Venture Intelligence League Table for Transaction Advisor to Private Equity Deals in 2025 advising 9 deals worth $2.6 Billion. Avendus stood second, having advised 20 deals worth $1.6 Billion. Ernst & Young followed with 14 deals worth $1 Billion. Jefferies & Co. took the fourth spot advising 3 deals worth $900 Million and Singhi Advisors having advised 1 deal worth $600 Million completed the top five for 2025.

Among the largest PE deals during 2025, Jefferies & Co. advised the $750 Million exit of Ontario Teachers Pension Plan from Sahyadri Hospitals. Singhi Advisors advised the $610 Million investment in auto components maker Dhoot Transmission by private equity firm Bain Capital.

Among the larger PE deals during Q4 2025, Standard Chartered Bank advised the $335 Million investment in Aditya Birla Renewables by Global Infrastructure Partners. Avendus advised the $280 Million investment co-led by Goldman Sachs and A91 Partners in customer engagement platform MoEngage. Ambit advised the $278 Million exit from Tata Capital Growth Fund in biotechnology firm Biocon Biologics.

The Venture Intelligence League Tables, the first such initiative exclusively tracking transactions involving India-based companies, are based on the value of PE and M&A transactions advised by Financial and Legal Advisory firms.

The full league table can be viewed online at https://www.ventureintelligence.com/leagues.php

By Industry (Excluding Due Diligence,Tax,Other Advisory Services)

Among PE transactions in the IT & ITES industry (by value), Avendus ($880 Million) stood first followed by PwC ($424 Million). Jefferies & Co. and Rothschild ($150 Million) took the third spot. o3 Capital ($120 Million) came fourth followed by Taxedge ($100 Million) which completed the top five. By deal volume, Avendus (10 deals) yet again topped the table, followed by Unitus Capital (4 deals).

Under the Healthcare & Life Sciences industry (by value), Jefferies & Co. ($752 Million) stood first, followed by Ambit ($278 Million). Veda Corporate Advisors ($249 Million) took the third spot. By deal volume, Veda Corporate Advisors (6 deals) topped the table, followed by Jefferies & Co., o3 Capital and Advay Capital which had advised 2 deals each.

Under the FMCG industry (by value), PwC ($1.6 Billion) stood first, followed by o3 Capital ($46 Million). Aeka Advisors ($35 Million) took the third spot. By deal volume, Aeka Advisors topped the table having advised 2 deals in the industry.

Under the Infrastructure* industry (by value), Ernst & Young ($542 Million) stood first, followed by Standard Chartered Bank ($335 Million) and PwC ($255 Million). By deal volume Ernst & Young topped the table after having advised 4 deals.

In the BFSI industry (by value) Avendus ($419 Million) stood first. Unitus Capital ($312 Million) took the second spot, with PwC ($227 Million) securing the third spot. By deal volume, Unitus Capital (9 deals) topped the table, followed by Avendus (4 deals).

*Infrastructure Industry includes: Energy (excluding equipment makers, Battery Swapping station), Engg. & Construction, Shipping & Logistics, Mining & Minerals, Telecom (excluding equipment vendors and VAS providers) and Travel & Transport (excluding travel agencies, portals, etc.).

Including Other Advisory Services

Inclusive of its roles in due diligence and related advisory activities, PwC topped the table, having advised 172 deals worth $19.61 Billion followed by Ernst & Young with 95 deals worth $11.04 Billion. Deloitte took the third spot having advised 33 deals worth $3.89 Billion. KPMG stood fourth, having advised 30 deals worth $2.83 Billion. Avendus completed the top 5 with 20 deals worth $1.56 Billion.

The full league table can be viewed online at https://www.ventureintelligence.com/leagues.php

To showcase your firms’ transactions in the 2026 League Tables, contact Vanathi at [email protected].

Venture Intelligence is India’s longest-serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital, and M&A) & their Valuations in India.

![]()