The Mint quotes:

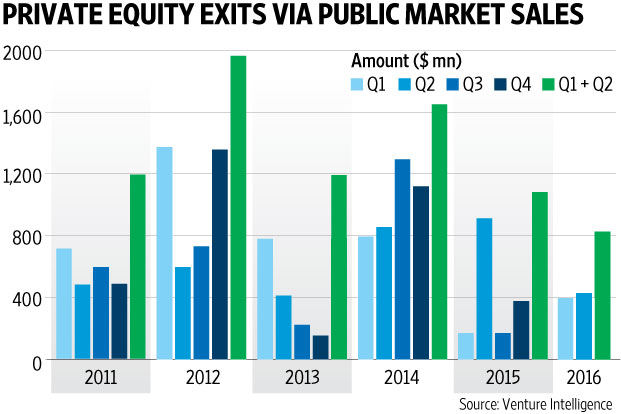

According to data available from Venture Intelligence, a research service focused on private company financials, during May-June 2016, PE funds invested $154 million in public equities, the lowest amount since April-June 2014 when PEs invested $205 million.

Since January this year, PEs have invested $414 million through PIPE deals, as compared to $1.12 billion during the corresponding period last year, a significant drop of 63%. In fact, except for 2014, when investors were in wait-and-watch mode ahead of the elections, the numbers are lowest in the last five years.

Reasons for the fall, according to the article include:

- The run up in valuations in preferred sectors e.g. Healthcare

- The large base in the previous year of more than $1 Billion invested in Listed companies by PE firms

Related: Private Equity Update for Q2 2016

Venture Intelligence is India’s longest serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital and M&A) & their Valuations in India.

![]()